The Cultural Narratives of Crypto

A brief note:

Maybe you don't know anything about "cryptocurrencies" or Bitcoin or any of that stuff.

Or, perhaps you know something about it, but you're kind of sick of hearing about it?

Well, this article is ostensibly about crypto, but it's really about cultural history and the impact of the internet on our institutions.

I say this in preface because crypto is very polarizing. I hope I've earned enough goodwill from you over time that you trust me to deal with the topic in an open-minded, interesting way.

Cool? Cool.

WTF is the deal with crypto?

Seriously.

These two tweets appeared nearly side-by-side on my timeline this morning:

Just like lotteries, crypto is a tax on the poor and financially illiterate. Except instead of it going to fund the state's public goods it goes towards the crypto bros to line their pockets and their projects to dismantle the state's institutions.

— Stephen Diehl (@smdiehl) January 13, 2022

And:

** web2:

— cdixon.eth (@cdixon) January 13, 2022

algorithmic feeds mediate fans and creators

surveillance / advertising business model

zero to low rev share with creators

** web3:

direct relationship between fans and creators

user-controlled privacy

very low platform take rates — creators get 90%+

(Web3, by the way, is essentially “the web on crypto,” for lack of any better definition).

Here you have two smart, rational people with completely opposite views. These views aren't just different - they're Utopian and Dystopian.

Is crypto leading us to a brighter future of diminished corporate control over our lives and culture?

Is it going to enable a creative renaissance where “artist” becomes a financially viable career choice?

Will it tear down government censorship, allow those in the developing world unprecedented access to capital and spread the wealth accumulated on Wall Street to the rest of the 99%?

OR...

Is the entire thing a Ponzi scheme, cooked up by extreme libertarians who want to dismantle the social safety net?

Is it nothing but hot-air, scams, and crime?

Will it enable terrorists, mobsters, and pedophiles to operate unencumbered…

All the way up until the point when it inevitably collapses, damaging the entire world economy and emptying the bank accounts of your gullible loved ones, paving the way for a fascist uprising in the United States?

If you think I have exaggerated any of the arguments above, I have not - these are all real positions being held, right now, by very smart, very well-intentioned people.

Whenever an issue is this divisive, I immediately become curious as to why. After all, we’re talking about technology here, not religion or sports. How can so many intelligent people look at the same set of information and come to such wildly differing conclusions?

More so than almost any of technology in my lifetime, the arguments over crypto are arguments over narrative. Crypto is, in many ways, an exercise in communal story-telling - about what the technology is, what it could be, and what it means. This isn't a radical thesis; most people in crypto openly acknowledge this fact.

Where people tend to differ is not in whether they think the current excitement and energy surrounding crypto is based primarily in narrative.

Where they differ is in whether or not they think that everything else is, too.

—-

Spoiler alert, if you don’t want to read the whole thing:

It’s complicated.

—-

THE AMERICA WE KNOW

Back when I was training to be a history teacher, I taught a class in Reconstruction (the period immediately following the Civil War).

The problem with teaching Reconstruction at my school was that the kids took that class in Junior Year…but learned about the Civil War in Freshman Year. They'd had an entire year to forget whatever they knew about the war.

Yes, you can teach Reconstruction by simply picking up at the end of the Civil War and forging ahead. But events don’t simply happen out of nowhere - they emerge, organically, from what preceded them. The events of the Civil War informed and created the events of Reconstruction. If you want to understand one, you really need to understand the other.

Crypto didn’t emerge out of nowhere, either. For better or for worse, crypto is a manifestation of our zeitgeist, our moment in time and all the intersecting currents that define it. So before we deal with cryptocurrencies, let’s talk about the 20th century.

If you’re like me, and have experienced the Second World War primarily through history books or documentaries, the horror of it all - the sheer, unimaginable scale of the destruction, madness, and terror - doesn’t quite come across. But that’s what it was: pure hell, breaking through all over the world, all at once.

After a collective trauma of such magnitude, life has a way of reasserting itself. For the United States - in our own estimation, the saviors of the world - this manifested in the “baby boom” and in decades of economic optimism and prosperity.

A unique element of this economic boom was that it was shared more equally across classes than many prosperous periods before it.

Average wages doubled from 1940 to 1948, and then doubled again by 1963. Interest rates were low, and credit became widely available. We became used to the idea of “household debt.” Middle-class Americans could afford to buy that new refrigerator, that new car...and they did.

It’s hard to overestimate the extent to which this period of American history still lingers in our collective unconscious. This is where the belief that “each generation does better than the last” comes from. The 50s, and it's “go-get-‘em” attitude towards the future, define America for many people to this day.

People measure their well being against their peers. And for most of the 1945-1980 period, people had a lot of what looked like peers to compare themselves to. Many people – most people – lived lives that were either equal or at least fathomable to those around them. The idea that people’s lives equalized as much as their incomes is an important point of this story...

America got used to “keeping up with the Joneses,” and that’s all well and good when prosperity is being widely distributed. When wages stopped keeping pagc with the economic gains of the wealthy, however, people didn’t adjust their spending. Instead, they took advantage of the explosion in consumer debt. This led to an acceleration in economic inequality.

Housel again:

Household debt-to-income stayed about flat from 1963 to 1973. Then it climbed, and climbed, and climbed:

Even as interest rates plunged, the percentage of income going to debt service payments rose. And it skewed toward lower-income groups. The share of income going toward debt and lease payments is just over 8% for the highest income groups – those with the biggest income gains – but over 21% for those below the 50th percentile.

Americans still believe they live in a classless society, no matter what the economic data says. It’s our national delusion, and, if I’m being honest, in many ways it's endearing. We don’t take social hierarchy seriously, and that’s helped to make us scrappy and entrepreneurial.

The dark side of that tendency is that we can often act against our own economic interests. We not only reject socialism on the grounds that we are all “temporarily embarrassed millionaires” - as John Steinbeck once said - but we also spend as if our fortunes are about to change. This belief has not kept pace with the underlying economics.

A sense of economic entitlement and growing inequality are not the only powerful forces at play, however.

Enter: the internet.

THE BORDER ATTACKS THE CENTER

I think most of us get that the internet was, like…real important.

You’ve got a computer in your pocket that’s thousands upon thousands of times more powerful than the one NASA used to put people on the moon.

Want to know literally anything - how tall Abraham Lincoln was, or how to reupholster your couch, or trigonometry? It’s all available, in an instant, for free.

Hey - remember long distance calling cards? Remember that? Yeah, well. Now you can FaceTime your Grandpa in Argentina for free.

Heck, even Better Questions is on the internet! Did you know that? It’s true - you’re on the internet right now! I can reach thousands of people with my writing for only a marginal cost.

The internet - the single most disruptive, transformative, mind-blowing technological innovation of our time - is so ubiquitous that we tend to take it for granted. We don’t really use the internet anymore; it might be safer to say that we swim in it, that we are extended by it in ways we are just barely beginning to understand.

Remember the Arab Spring?

In 2011, the Tunisian government was brought down by a public in revolt in just 28 days.

How did such a massive popular uprising occur so quickly?

Mark Zuckerberg, at the time, said that social media was “fundamentally rewiring the world,” and he was right.

Blogs, social media, podcasts, YouTube, all made the “public,” a once largely-undifferentiated mass of people reliant on centralized communication channels for news and understanding - able to talk and organize directly with one another across any distance.

This was, to put it mildly, a big deal.

Martin Gurri, in The Revolt of the Public, theorizes that many of the more surprising social movements of our time - the Arab Spring, Occupy Wall Street, the Tea Party Patriots, the election of Barack Obama (and I’ll add, since Revolt was written before these occurred, the election of Donald Trump and the rise of QAnon) - are manifestations of a broader trend of social reorganization both prompted and enabled by the internet.

The 20th Century was not exactly a humble one. Governments all over the world had grand ambitions, whether they were massive infrastructure projects, sweeping social and economic reforms, or literally refashioning the world into a Utopia (see: Stalin, Hitler, Mao, etc.)

James Scott, in Seeing Like a State, calls these “high modernist” ambitions. It was an age where we believed in the power of human rationality to improve on “the way things were.” Nature and historical accident alike could be reshaped for the better.

It didn’t go well. Perhaps that’s an unfair characterization, but it’s hard for me, personally, to get past the Holocaust, the Gulag, and the Cultural Revolution. Our aspirations seem to have outstripped our humanity.

A greater understanding of ecology, systems dynamics, uncertainty and complexity have, over time, eroded our belief that grand, top-down plans can effect massive positive change. The modern approach is largely ground-up, and favors a minimalist approach (at least, among academics).

A critical point, however, is that the way our politicians speak, and our expectations of them, have not changed.

The government and the public both used to believe that governmental action could solve the biggest problems of human existence - poverty, inequality, justice.

Governmental officials no longer believe this, but the public still does. Our political style retains the trappings of high modernism: see Barack Obama, campaigning on nothing less than “Hope.”

Let’s take a step back for a moment and recall where we are:

- A period of shared economic prosperity has embedded in American culture a belief that the lifestyles of the rich and poor will not differ too much.

- Meanwhile, economic inequality is accelerating, and our expectations have no kept pace with reality.

- In politics, an age of grand plans and ambitions have created an expectation that government is and should be able to fix the biggest problems of human life. Our expectations, again, have not kept pace with reality.

Cue the internet.

In the past, when big governmental plans failed (and fail they did), the public’s exposure was fairly limited.

Newspapers often had a “chummy” relationship with the powerful people they covered. Newspaper owners had their own specific political agendas and manipulated coverage accordingly. Many people, just like today, simply didn’t care much for politics, and didn’t bother to keep up. What’s more, local issues seemed more pressing - there wasn’t much awareness of what was happening two or three towns over, much less halfway across the country.

The internet changed all that.

Now, when something fails, everyone knows about it. National politics is what grabs our attention - emotional, “hot button” issues divorced from our day-to-day lives. If there’s an issue you care about, it’s easy to track events related to that issue happening anywhere in the world. What's more, the holders of power are far more accessible - you can tweet at your Congressperson and get a response!

This openness and transparency can be amazing, but it also lays bare the shortcomings of government.

As it turns out, the government has never done a particularly good job of achieving its more utopian ambitions. Any belief we have that government “used to be more effective” is largely driven by the fact that failures used to be more easily swept under the rug. Now, every misstep is broadcast loudly for all to hear…and those most enraged by that failure, whether it be in environmental regulation or social justice or too much environmental regulation and social justice, have a new public square in which to hold government to account.

To be clear, I’m not saying that government is uniquely bad at getting things done. In fact, most things fail. Failure is the norm in every endeavor. It’s just that our expectations for government have not kept up with our awareness of it’s shortcomings.

We still expect the government to be able to fix our problems, and thus, when they don’t - when things blow up, or fail, or fall apart, or get mired in politics - we attribute that failure to incompetence, corruption, or both.

Politicians make big promises they can’t possible deliver on (whether it’s “Drain the swamp!” or “CHANGE”). Even small successes feel like failures in contrast. Everyone finds out about it, and well…we get mad. Real mad.

We’re online, we’re anonymous, we’ve done the research, we know the answer and it’s so obvious, why don’t these corrupt bureaucrats actually DO something for a change?

This oscillating pattern of big promises and high ambitions followed very public failure and rage is the mechanism by which our trust in institutions - government, finance, education - has been eroded.

And when I say eroded, I mean ERODED.

Trust in every centralized source of authority - from Congress to public schools to the church - has plummeted over the last 50 years.

We haven’t lost faith in the ability of institutions to fix things; we still believe that the “right people” in power could push the “magic-make-everything-better” button and Make America Great Again. The fact that things continue to be “Not Great” is just evidence that they haven’t pushed the “magic-make-everything-better” button and are thus corrupt, immoral, indefensible fools.

What happens when people lose faith in institutions, in the centralization of power? They look elsewhere, to outsiders, to those who want to “clean up the system” and “change things.” They look, in other words, to the Border.

Those outside of traditional power structures have used the internet to repeatedly attack, and many times unseat, those in power.

The Arab Spring is one example; the election of Marjorie Taylor-Greene (a vocal QAnon proponent) to Congress is another. The surest way to find common ground in todays politics is to simply attack those in power, because everyone is upset with those in power about something. The more radical your plan to “sweep things clean,” the more appealing it becomes.

Gurri predicts as much:

If the industrial-age hierarchies of contemporary democracy are suffering a crisis of authority, if the public is on the move and expecting impossibilities, then, all things equal, the system will continue to bleed away legitimacy—and there will be those who argue it should be put out of its misery.

Many of these upstarts have been swept into power only to fall victim to the exact same dynamic that got them there. In fact, the only way to stay in power is to continuously attack those in power and pretend to have none. They can never afford to “win;” they always need to be the underdog, even if they’re president of the United States (both Obama and Trump utilized this tactic, with varying degrees of subtlety).

This is the border, attacking the center - and it’s happening on every level of our society. It’s happening in science, it’s happening in culture, it’s happening everywhere.

If there is a single mental model that clarifies some of the more-perplexing aspects of society today, it is The Border attacking the Center.

—

LOTTERY CULTURE

Our first two themes are big ones: the rise of economic inequality and the internet enabling the border to attack the center. These two things will play deeply into our understanding of crypto.

There’s another, more proximal cause that I’d like to examine, however, and that’s the rise of lottery culture.

Lottery culture is a term coined by John Luttig. To understand what he means, let’s examine our previous statement that economic inequality is accelerating.

Luttig points out that even economic inequality is unevenly distributed:

The Gini coefficient is a classical measure of inequality, and it did increase from 0.43 in 1990 to 0.48 in 2020. But the inequality is far clearer on industry lines: the NASDAQ has generated 2.5x better returns than the S&P 500 since 2008. When the growth of tech’s contribution to GDP far outpaces other industries, but its total employment stays roughly flat, it is hard not to see the rest of the country missing out.

What’s more, our economic inequality is more visible than ever. Social media has allowed us unprecedented insight into the lifestyles of the super-rich. Remember: we tend to estimate how we’re doing based on who we perceive as our peer group. We might feel unsatisfied with our lot in life, even if we’re doing relatively well, if we can see our friends retiring early because they went viral on Tik-Tok.

Social media acts as an emotional coordination layer, increasing the amplitude and frequency of culture. Jealousy, resentment, and fomo are more viral and powerful than ever, particularly when everyone is on their computer all day post-lockdown.

FOMO - fear of missing out - and it’s attendant rainbow of anxiety-flavors is, in may ways, the defining feature of today's economic climate.

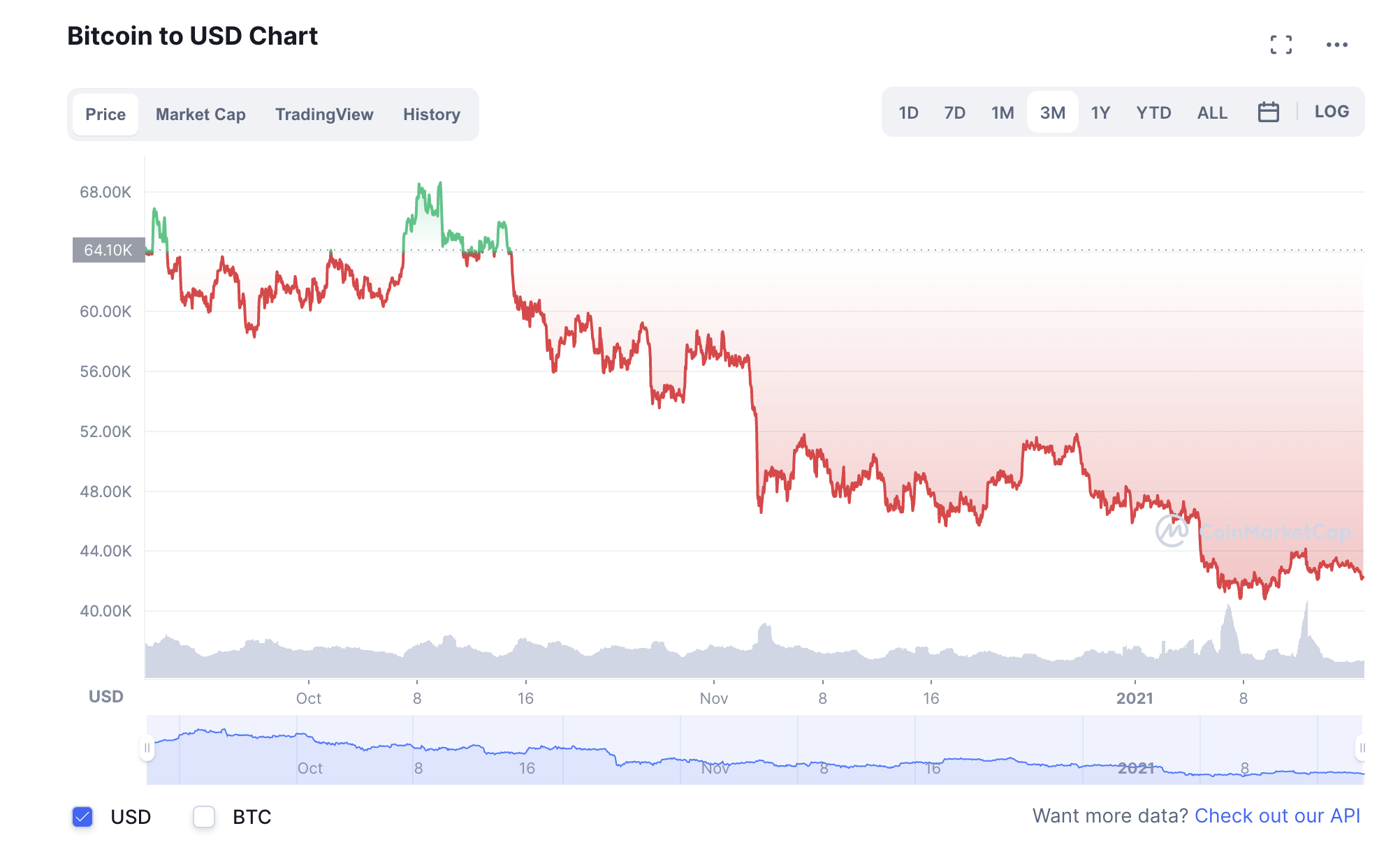

None of us really seem to believe that Social Security is going to be enough to support us in our old age (remember, we don't trust institutions). We don't tend to stay long enough at any one job to receive anything like the retirement packages earlier generations received; even if we did, they're not being offered, anyway. The cost of living is rising, wages are stagnant...and, oh yeah, inflation is on the rise, as well. That means that even if you've saved money, you're losing cash every day by leaving it in the bank.

Many people today feel like the entire economy is rigged against them, a system where only those who control our financial institutions benefit.

They also feel like their ability to retire or experience financial freedom is contingent on some kind of "lottery-like" event - picking the right stock, working for the right tech start up early, etc.

Our expectations of equality are not only flouted - they are thrown back in our face every day by social media. We watch our "peers" getting rich and feel left behind.

Our culture - fueled by jealousy, fear, frustration, stagnation - wants desperately to unseat those in power from those in the "center."

Enter:

Cryptocurrency.

---

WHAT CRYPTO MEANS

Let's leave aside, for a second, all technical questions about crypto, and what it could be, and what it means, and it's potential downsides. There's a lot there, and this is already a long piece.

When I first started this project, I had one big question, which was:

Why are people investing in cryptocurrency?

From a traditional value-investing perspective, crypto makes absolutely no sense at all.

Let's say I'm an old-school investor, wondering whether to buy stock in a company that makes shoes.

Let's say that shares in this company are trading at $1 a piece.

I'd do my research, learning all I could about the company, it's leadership, it's equipment, how much debt it's carrying, etc.

Imagine that, after doing all this research, I realize that there's quite a bit of growth potential for this company. They're using outdated machinery, and if they upgrade their output will double. There's also some strategic moves they could make in their marketing that I believe will boost their revenues.

After doing all this research, I might realize that other people in the market haven't factored in all this growth potential. That might mean that the stock is undervalued: I can buy it at $1 today, but in my estimation it's actually worth $2, based on my beliefs about their growth potential and so on.

In this scenario my valuation of the company is based on their historical cash flows (the company is worth at a bare minimum, the cash flow it is generating), plus whatever growth I believe is possible based on my experience with the industry.

Crypto has none of this.

For one, crypto produces no cash flow outside of investment activity. You can't use cryptocurrencies for anything other than selling them to other investors. There's no underlying economic activity, like the production of shoes, to point to.

(This is what leads many people to call crypto a "Ponzi scheme," since in order for you to make money on your crypto investment someone else has to buy in).

Secondly, no one knows where crypto is going to end up, nor do we have historical data to point to in order to evaluate our predictions. Blockchains (the tech that underlies Bitcoin, Ethereum, and other crypto projects) have been around for about 12 years or so. In that time, they haven't done much of anything, other than...enable investment in crypto.

For people to invest in something, they need to believe that that thing will be worth more in the future. Every single person who buys Bitcoin or Ethereum or any other cryptocurrency is doing so with the belief that it will be worth more in the future.

And yet, by traditional value investing standards, every single cryptocurrency is completely worthless. No historical cash flows, no value.

So...

Why?

Why are so many smart people investing in crypto? And not just smart people, but large financial instutitions?

Is everyone caught up in a bubble?

Is it simple herd-thinking, a kind of shared delusion?

Is it simply people looking to make a quick buck, convinced they can time the market and get off the ride before the music stops?

It's probably all those things.

But if the only question about crypto that matters (from an investment perspective) is "will this be worth more in the future?"....

Then I think the answer is probably yes.

And it has nothing to do with cash flows, or historical data, or even what the technology will end up being used for.

To me, crypto is a manifestation of the border attacking the center.

It is the exact same social dynamic that enabled Obama and Trump to be elected, that motivated Occupy Wall Street and the Tea Party.

People have lost faith in financial institutions.

People no longer believe they will be protected or provided for by those in power.

People are angry.

They are hurt.

And they are ready to tear everything down and start over.

I'm not arguing that they are right, by the way. I'm not arguing that these ideas hold water, or will make the world a better place.

But investing is not about reality.

It is about narrative.

It's about what other people believe.

To answer the question "will crypto be worth more in the future than it is today," we have to first answer this question:

"Is the border going to continue to attack the center?"

I believe it is.

And I believe that people are going to continue to see cryptocurrency as one front of their war against the center.

I believe people will see crypto as a lottery ticket, some cash under the mattress, and a big middle-finger to central bankers, the Fed and Wall Street...

All at once.

To put it another way:

Crypto is an investment...

But it is also a manifestation of rage.

And I think it would be a huge mistake for any of to underestimate the extent of the rage that people feel together, across all walks of life.

So, yes.

I think the crypto will be worth more in the future than it is today.

Does that mean you should invest in it?

No.

For one, you should absolutely never, under any circumstances, take investment advice from someone like me. I know jack squat about anything.

Secondly, there is way more to crypto than it's potential as an investment vehicle.

That's another deep topic, and I hope to dive into that soon.

What I do think everyone should do is spend some time reading and learning about this space.

Maybe you come out pro-crypto, maybe you come out anti-crypto.

But make sure to expose yourself to opposing views and to read as widely as you can.

Whether or not you think crypto is Utopian or Dystopian or somewhere in between, I think it's going to have a huge effect on our culture and politics moving forward. It's something worth knowing about.

Until then, as a brief reminder of the risks involved, I present to you the price of Bitcoin (in USD) over the last three months.

Stay safe out there, folks.

Yours,

Dan

COOL STUFF TO READ:

Since we've talked about risk a bit today, here's a classic from the previously-mentioned Morgan Housel: The Three Sides of Risk.

There are three distinct sides of risk:

The odds you will get hit.

The average consequences of getting hit.

The tail-end consequences of getting hit.

Better Questions Newsletter

Join the newsletter to receive the latest updates in your inbox.